Why Your FinTech Business Should Consider Data Analytics Outsourcing in 2024

Big data analytics has become crucial for FinTech businesses, offering powerful insights that drive innovation and competitive advantage. Here's a comprehensive guide on data analytics outsourcing in FinTech.

Hands with phone showing fintech data

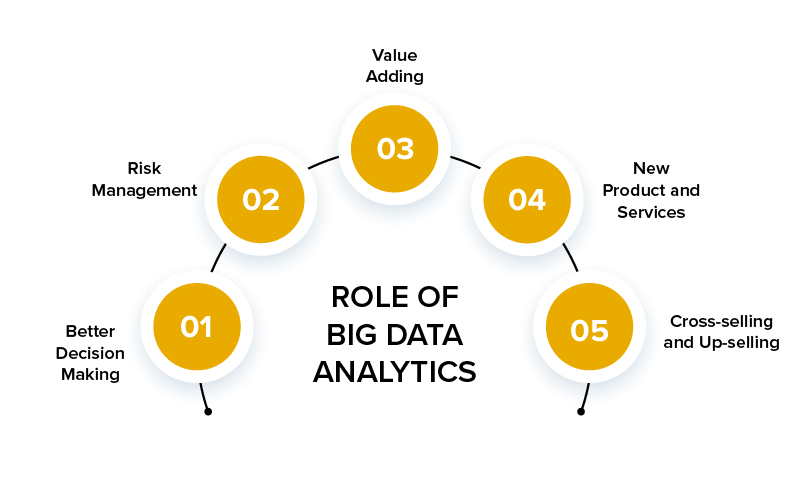

Key Applications of Big Data Analytics in FinTech:

1. Insurance: Modern risk assessment and dynamic policy pricing 2. Digital Payments: Fraud detection and instant credit decisions 3. Real Estate: Market monitoring and dynamic pricing 4. Lending: Improved credit accessibility and risk assessment 5. Wealth Management: Personalized financial planning and customer retention

Big Data Roles and Functions Diagram

Benefits of Data Analytics Outsourcing:

1. Expert Access: Specialized knowledge without internal hiring 2. Cost Efficiency: Reduced operational and overhead expenses 3. Scalability: Flexible adaptation to business needs 4. Solution Variety: Multiple options for implementation 5. Customization: Tailored solutions for specific business requirements

Big data solutions diagram

Key Considerations When Choosing an Outsourcing Partner:

1. Proven Track Record: Verify experience in FinTech solutions 2. Security Measures: Strong data protection protocols 3. Risk Management: Clear contingency plans 4. Industry Expertise: Understanding of FinTech nuances 5. Technical Capabilities: Modern technology stack

Advantages:

- Access to specialized talent

- Latest technology adoption

- Customer-centric approach

- Cost-effective operations

- Scalable solutions

Challenges to Consider:

- Potential communication gaps

- Data security concerns

- Business objective alignment

The FinTech industry is expected to reach $28529.29 billion by 2025, growing at 6% CAGR. With 66% of consumers expecting personalized services, data analytics has become essential for success in the FinTech sector.

[Additional images retained as in original content]