State Farm-like Auto Insurance App Development: Cost Breakdown and Pricing Guide

Auto insurance app development typically costs between $45,000 and $60,000, varying based on several key factors. This comprehensive guide breaks down the essential components and costs.

The auto insurance market shows significant growth potential, with increasing demand for mobile solutions that connect users to insurance providers.

Key factors affecting development costs:

-

,[object Object],

- iOS vs Android development

- Native or cross-platform approach

-

,[object Object],

- In-house development vs outsourcing

- Team size and expertise required

-

,[object Object],

- US/UK developers command higher rates

- Asian development teams offer cost advantages

-

,[object Object],

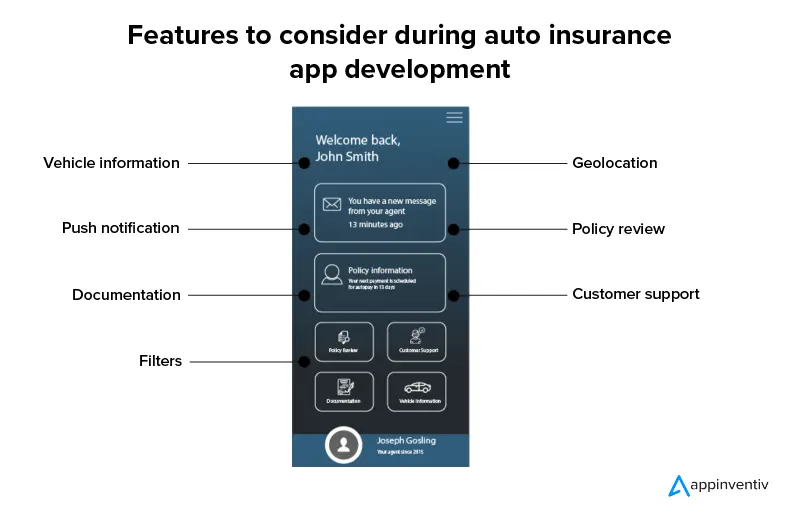

- Vehicle information management

- Push notifications

- Document upload capability

- Geolocation services

- Policy filters

- Policy review system

- Customer support integration

Auto insurance app key features

Technical Requirements:

- Frontend: React Native/Swift/Kotlin

- Backend: Node.js/Python

- Database: MongoDB/PostgreSQL

- Cloud: AWS/Google Cloud

- Analytics: Firebase/Mixpanel

Revenue Generation Methods:

-

,[object Object],

,[object Object],

,[object Object],

Cost-Saving Tips:

- Start with MVP development

- Prioritize essential features

- Choose appropriate technology stack

- Consider offshore development

Development Timeline:

- MVP version: 4-8 months

- Full version: 6-12 months

Tech stack icons in grid layout

For optimal results, consider starting with a minimum viable product (MVP) to validate market fit while managing development costs effectively.

Related Articles

How to Build a Secure FinTech App: Essential Cybersecurity Measures and Best Practices