Insurance Automation: How RPA is Revolutionizing the Insurance Industry in 2024

Insurance automation through Robotic Process Automation (RPA) is transforming the insurance sector by streamlining operations and enhancing customer experience. Here's what you need to know about this revolutionary technology.

RPA in insurance automates routine tasks like data entry, record maintenance, and transaction processing. The global RPA market is projected to reach $1202.1 million by 2026, while the insurtech industry is expected to hit $261.6 billion.

Robot assisting man with insurance policy

Key Benefits of Insurance Automation:

- Increases accuracy by 70-80%

- Enhances response speed by 80%

- Reduces operational costs

- Minimizes human errors

- Improves sales growth

- Enables enterprise scalability

RPA revenue growth trend chart

Major RPA Use Cases in Insurance:

- Claims Processing - 75% faster than manual processing

- Underwriting Processes - Automated risk evaluation and data analysis

- Sales and Distribution - Simplified reporting and compliance checks

- Regulatory Compliance - Enhanced monitoring and validation

- Policy Administration - Streamlined transactions and renewals

- Business Analytics - Improved operational efficiency

- Query Resolution - Automated customer service

- Legacy System Integration - Seamless connection between old and new systems

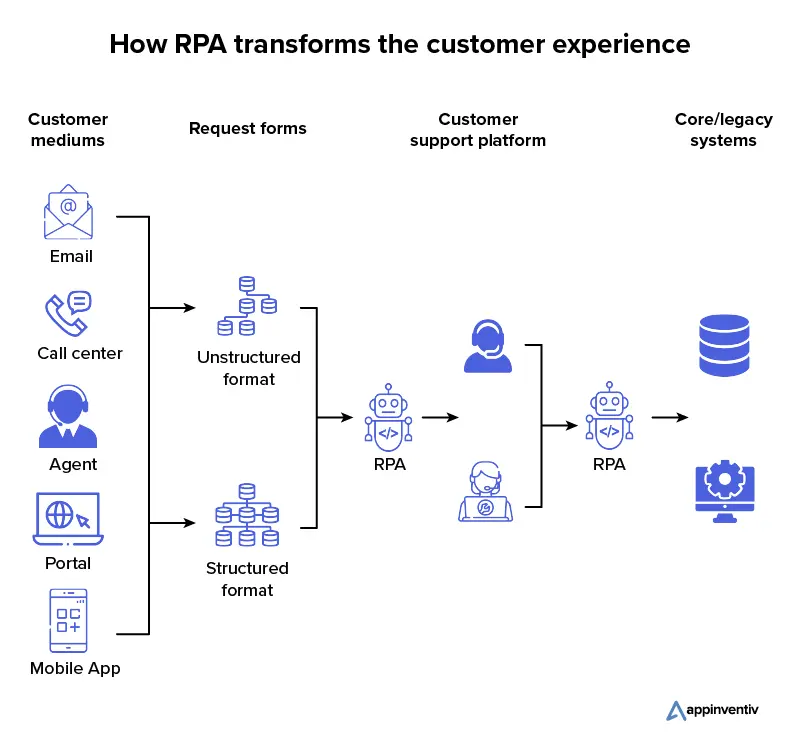

RPA workflow automation diagram

How RPA Works in Insurance:

- Links disparate systems with minimal coding

- Processes emails and data automatically

- Integrates with workflow automation

- Utilizes AI for enhanced capabilities

- Generates profitability reports

- Manages data across multiple systems

The insurance industry is expected to automate 25% of its processes by 2025. According to Gartner, the banking, finance, and insurance sector invested $2.4 billion in RPA solutions in 2022, making them leading adopters of this technology.

By implementing RPA, insurance companies can focus on delivering better customer experiences while automating time-consuming backend processes, ultimately driving innovation and growth in the sector.

[Continue with additional images and sections as in original article...]

Related Articles

The Ultimate Guide to Modern FinTech Business Models in 2024