How Much Does It Cost to Develop a Payment Super App Like myFawry in 2024?

The Middle East's digital transformation, particularly in Egypt, has seen significant growth post-COVID. With government initiatives supporting ICT infrastructure and digital inclusion, Egyptian startups raised $491 million across 147 deals, with Fintech accounting for 17%. One standout success is myFawry, Egypt's largest financial services provider.

myFawry is a Fintech super app enabling payments, investments, borrowing, and rewards across 225,000 locations in Egypt. It achieved unicorn status in 2020, with a $1 billion valuation.

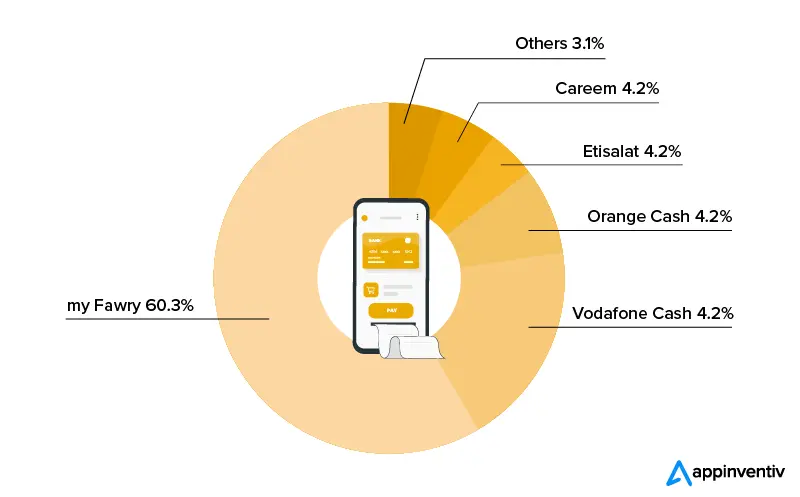

Pie chart showing payment app costs

Development costs for a similar platform range from $180,000 to $220,000, varying based on design, features, platforms, and integrations.

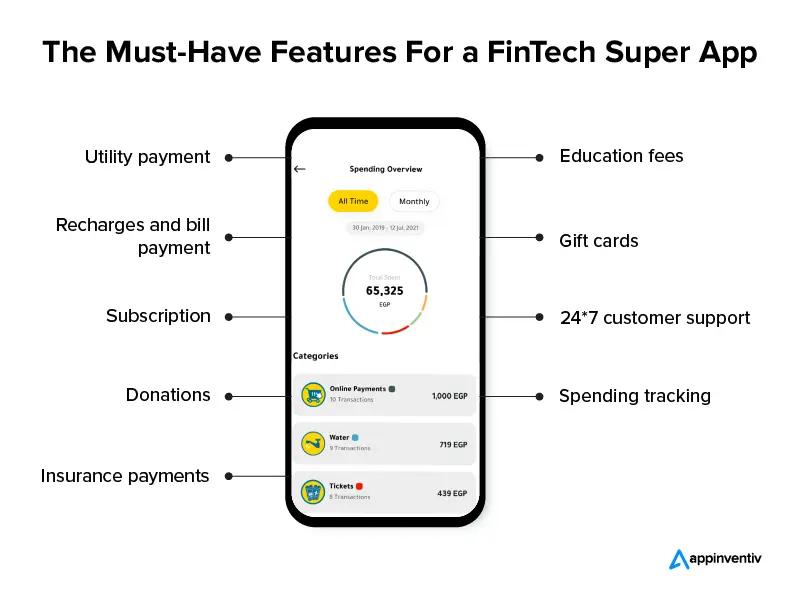

Essential Features:

- Utility payments

- Bill payments and recharges

- Subscription management

- Donation capabilities

- Insurance payments

- Education fees

- Gift cards

- 24/7 customer support

- Expense tracking

Fintech app features flowchart diagram

Development Process:

- Feature selection and planning

- Design system creation

- Frontend and backend development

- API integrations

- Testing and security validation

- Deployment across platforms

Success Factors:

- Comprehensive service offerings

- User-friendly design

- Strategic partnerships with banks and institutions

- Regular updates and improvements

- Strong security measures

The development timeline typically ranges from 6 to 18 months, depending on complexity and scope. Key to success is understanding target audience needs and maintaining robust technical infrastructure.

For optimal results, partner with experienced developers who understand both technical requirements and local market demands. Ensure compliance with regional regulations and implement strong security measures to protect user data and transactions.

Related Articles

The Ultimate Guide to Modern FinTech Business Models in 2024